Merchants today are prioritizing innovative ways to retain and monetize their existing customer base, moving away from traditional customer acquisition methods. This significant shift demonstrates how subscription-based businesses are adapting to the prevailing macroeconomic environment.

A pivotal discovery underlining this change comes from a recent “2023 State of Industry Report” by subscription billing software firm Chargebee.

In a study conducted between March 18 and April 15, 2023, Chargebee researchers analyzed the customer retention activities of over 318 leaders in the subscription business industry. The 28-question survey examined how these leaders adapted to changing market conditions, covering revenue and churn expectations, business strategies, budgets, and retention tactics for subscription businesses.

The research heralds the dawn of a “Retention Era,” where customer retention has become the top priority for 87% of the surveyed businesses. The strategy ranks on par with or surpasses traditional new customer acquisition methods.

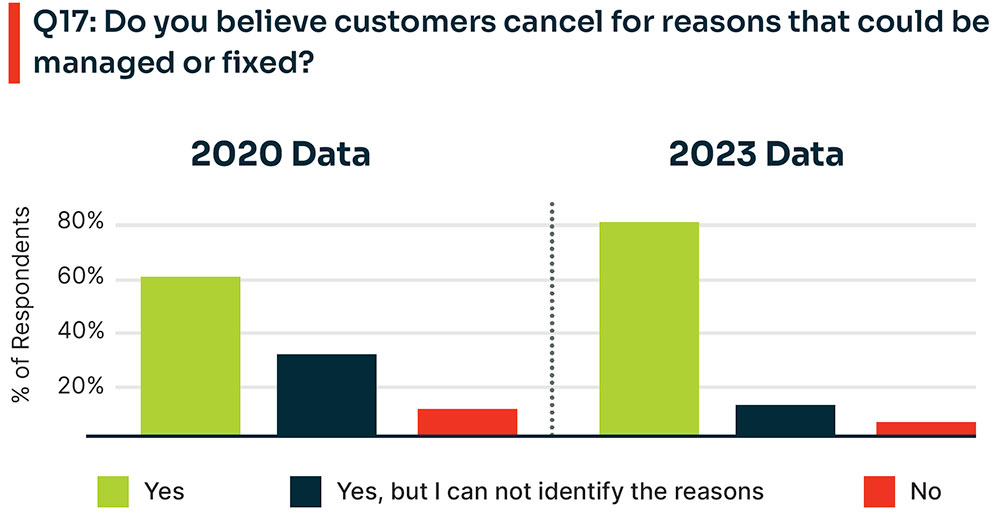

Chargebee’s findings further reveal that 96% of subscription business executives believe customers cancel for reasons that could be managed or fixed.

Source: Chargebee 2023 State of Subscription Industry Report

Retention-Focused Investments

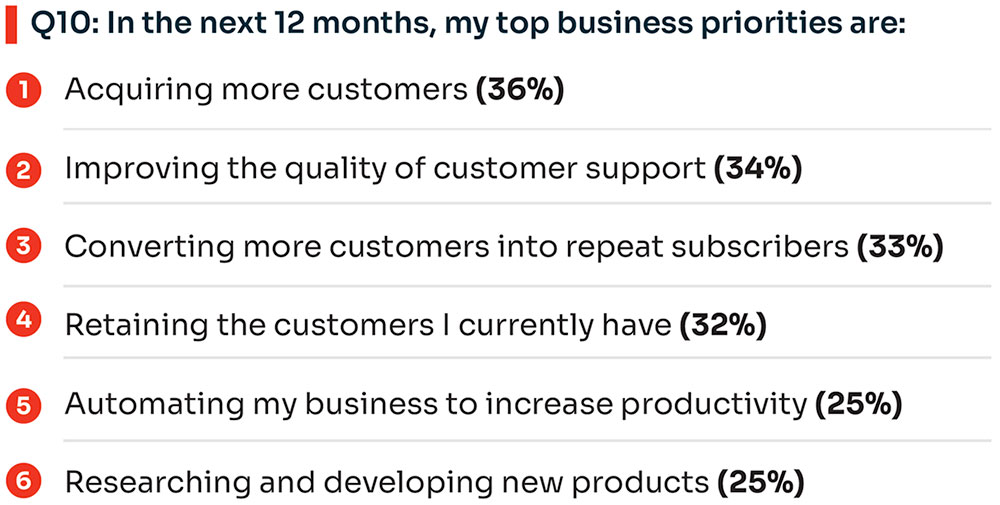

Companies are adjusting their strategies this year. The tactical shift has moved from battling churn through adjusting priorities and budgets to a more focused approach — generating revenue from existing customers.

The report indicates a rising trend in customer attrition, with 64% of respondent companies anticipating an increase in churn this year. The change in investment priorities reflects 51% increasing spending in technology, 32% in initiatives, and 27% in loyalty programs.

“This year has brought rapid change to the business landscape, with companies, no matter what business model they employ, finding ways to prioritize investment for continued growth,” observed Guy Marion, chief marketing officer at Chargebee.

Data shows that a majority of business-to-business (B2B) and direct-to-customer (DTC) subscription businesses expect an increase in churn and therefore need a strong investment strategy to maintain and grow revenue, he said.

“The smart bet is on retention, a more direct and efficient approach to long-term growth that places customers at the center of business,” he offered.

Concerns Extend Beyond Churn

Respondents also report that their top concern for this year is keeping up with rapidly changing technology and the profound impact of artificial intelligence (AI) on operations. Keeping pace will prove business-critical as companies seek to remain competitive amid rising consumer demand and technological advancements across all industries.

Despite challenges, optimism prevails, with 79% of businesses forecasting growth this year. As for pricing trends, the vast majority anticipate either stability or escalation, with 92% of subscription businesses predicting their prices to rise or maintain their current levels.

The leading growth strategy involves enhancing the quality and responsiveness of customer success and support services. Slowing down customer churn remains the primary business challenge for subscription-based sales.

That reflects the significant changes over the last two years. Pre-Covid, companies were still in the “growth at all costs” era. According to Marion, money flowed more freely, and that impact was seen in how product market strategies and consumer spending behaviors were fairing.

Churn Chaos

“At this stage, companies were just starting to understand the importance of retention. In our 2020 report, 93% of respondents felt retention was as or more important than acquisition,” he told The E-Commerce Times.

Churn was at 2% to 3.9%, and 69% of B2C companies had a churn target. In 2020, 96% of the surveyed companies believed they could manage the reasons causing customers to leave. But 31% were unable to identify those reasons, noted Marion.

Then, the pandemic hit. Disposable income was more readily available during this period, and businesses experienced a customer surge. Many retailers switched to digital, and the impact was positive across the board.

“As we eased out of the pandemic into a more economically tight landscape, spending went down, and B2C businesses started to experience pullbacks from what has been called subscription fatigue,” he explained.

Today, increased churn rates across the industry reflect this fatigue. Based on Chargebee benchmark data, 42% of B2C companies are churning 3% or more monthly, and 16% are churning 4% or more. According to Marion, the average is close to 6%, nearly double the pre-pandemic average.

Tech Spend, Loyalty Programs Solutions to Churn

Not all indicators have been negative, however. In this current report, Marion sees a similar statistic of those who believe customer cancellations could be addressed and resolved (96%). Still, only 15% state they do not know the reason — a 52% decline.

“This tells us that perceptions have not dramatically changed in the past few years, but the ability to execute has improved substantially. Companies are showing a maturation in managing and curbing cancellations due to improvements in operational efficiencies and capabilities,” Marion reported.

The spending on technology, tools, and retention initiatives differ significantly from 2020 to 2023. In 2020, businesses spent 15% on technology and tools. Now they are spending 51%. Meanwhile, retention initiative spending went from 14% in 2020 to 32% in 2023.

This data demonstrates that businesses have gained a much more robust understanding of consumer behaviors with technologies like Chargebee Retention that offer predictive analytics and data for making more intelligent business decisions, he suggested.

As one example, a self-care and beauty brand decreased churn from 12.5% to less than 9% by offering improved personalization and upgrade offers at the annual renewal moment. That reduced cancelations through proactive churn deflection and support gestures. They also launched new loyalty programs to build brand loyalty and retention and anticipate growth in the next year.

Growth and Retention Strategies

Retailers and marketers must adapt to falling budgets and rising costs as consumers scale down their abilities to maintain their previous shopping patterns. The first thing this report tells Marion is that the only constant is change.

“We see similar trends over the years, but the reaction to those trends shows progress. Companies are investing in technology and automation to improve productivity and efficiency, to improve the customer experience, and to track the right results to improve the accuracy of decision making,” he observed.

From AI technologies like ChatGPT, which are transforming customer service and content generation, to the tight labor market and rising interest rates, B2C companies are most concerned about the impact of external forces on their business. They plan on spending more on tech to support their growth and retention efforts, he added.

“Of the top five priorities that B2C companies are spending more on, three are retention-related,” said Marion.

B2C companies are also responding to the increase in churn with growth strategies that prioritize keeping existing customers happy. This year, improving customer service and onboarding are primary focuses for B2C businesses.

Source: Chargebee 2023 State of Subscription Industry Report

Fluid Retention Strategies Needed

The subscription model is evolving, requiring companies to realign with consumer behaviors continually, advised Marion.

He sees more companies innovating their business models to present new experiences for customers. Consider Porsche’s new drive product that won a Cube award at SubSummit 2023. It is a membership-based subscription for Porsche enthusiasts to access near-new vehicles on a flexible monthly basis.

“Companies that only offer one-size-fits-all solutions may struggle to keep up with the changing needs of customers, especially when combined with an increased need for efficiency,” he concluded.

According to Marion, churn is not as scary as it once was, especially with new technologies to combat it, and with 27% of companies now prioritizing loyalty programs.

A big surprise for him was the general sense of optimism in the report. It showed that 94% of businesses who believe their churn rates will increase also expect their revenue to increase.

Businesses are proactively reallocating budgets to improve customer experience by leveraging new tactics and technologies. Almost half (46%) of respondents consider enhancing the quality and responsiveness of customer support as a critical strategy for the year.