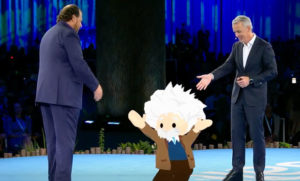

Salesforce.com’s major Dreamforce news was, as the company itself admitted, the worst-kept secret at the show. Marc Benioff, no less, spilled the beans about it during the summer; the crowd for his keynote was there largely to see it in action.

It’s a beautiful-looking analytics program. The graphic representations of data are simple, clean and automatically animated. The integration with Salesforce.com means that sales and marketing managers can add another tool to their arsenals without much help needed from IT. They may need a sign-off from the CFO, however, since “Wave,” as the analytics application is dubbed, goes for US$125 to $250 per month, depending on role.

So, the technical challenges are largely addressed. That’s great — but that’s only part of the puzzle. The real challenge for sales managers, marketers and anyone trying to improve their businesses with analytics is not technological — it’s a question of knowing what to look for.

The Right Questions

Salesforce recognized that in its keynote demo, with the example of a boat manufacturer analyzing sales and adjusting the location of its inventory to match recent trends. Naturally, Wave handled this problem with aplomb — and it did so partly because the technology is truly good — but mostly because the problem was well-defined.

“If you don’t ask the right questions, you’re not going to get the right answers,” commented Doug Landis, VP of sales productivity at Box, in a Wednesday panel discussion. He’s right — the peril of big analytics is that it can deceive users into thinking that discoveries will just happen.

They do, sometimes. History is filled with stories of explorers and scientists stumbling across important things. Most of their undirected explorations came up empty, however. The point of big analysis is to make those discoveries easier and more possible to find. Like almost all business software, it’s about productivity. Running constant analyses without an objective other than to find something is less productive than not running any analyses at all.

Instead — and to Landis’ point — it’s vital to know what you’re hunting for. Understanding your business — and the correlation of events that indicate things about your business — is vital to knowing what analysis to do in the first place.

If you understand your business, you can then start to ponder how two or three or four data points connect to each other, and then use the data to search for answers.

No Substitute for Creative Thinking

Here is where Wave and other analytics tools really can prove their worth: by giving imaginative sales managers and marketers the horsepower to quickly test correlations and determine whether they are pertinent measures of their business’ performance and the factors that affect it.

Making it easy to examine the data and establish cause-and-effect relationships — and then visualize the data easily — is tremendously useful, especially when that data is seen within the context of the business.

Still, knowing what you want to know is not always easy. To really use Wave to its best advantage, the onus is on both Salesforce and the users. Salesforce needs to be aggressive in its content marketing and help educate its customers in an ongoing way about how to use the application right — not only using case studies, but also providing some inspirational and aspirational content to help customers think about extending the depth of what they’re measuring.

At the same time, Salesforce needs to avoid the trap of overpromising on Wave and trying to convince customers that it’s a business intelligence panacea that will make all that is unknown known. Overpromising and undereducating is a great way to condemn an application to a slow, resentment-driven death. That would be a shame, considering Wave’s interesting capabilities.

By the same token, users need to approach analytics not as a substitute for creative thinking about their businesses, but as a tool to verify their hunches and test their assumptions. They need to stretch their ideas of which metrics are important for their businesses.

Smart companies will recognize that there are analyses that can give them unique insight and a competitive edge if they can discover them — but the groundbreaking metrics for one successful business will be radically different than those of another. It’s up to business leaders to be thoughtful, creative and clever in determining what to analyze — and to realize when their experiments are not paying off and switch gears.