Pitney Bowes on Monday unveiled Consumer Connect, a self-service post-purchase marketing solution for retailers and brands.

Pitney Bowes provides commerce solutions in the areas of shipping and mailing, data and e-commerce. The Consumer Connect service helps retailers drive new revenue after shoppers press the buy button. It enables retailers to create a branded tracking and post-purchase experience.

“Retail marketers spend a tremendous amount of time and money attracting consumers and getting them to click the buy button only to leave them in the hands of third-party shipping partners for tracking and notifications until the package is delivered,” said Lila Snyder, executive vice president and president of commerce services at Pitney Bowes.

That shift of control to third-party shippers created an opportunity for a solution like Consumer Connect. For the first time, Pitney Bowes has placed control of the post-purchase experience fully in the hands of retail marketers, she said.

Industry data shows that a package will receive an average of eight tracking requests between shipment and delivery. In most cases, that experience is basic, boring and off-brand, Snyder noted.

“Consumer Connect addresses this issue, transforming shipment tracking into a dynamic extension of a retailer’s brand experience, ultimately driving more meaningful consumer engagement and new revenue opportunities,” she said.

Supports Key Trend

With this new offering, Pitney Bowes aims to support a key trend. It recognizes that customer relationships are continuous and evolve over time, through every interaction, according to Nicole France, principal analyst at Constellation Research.

“Successful companies are using their customer understanding and insights to design experiences at every point in their customer relationships, including post-purchase,” she told CRM Buyer.

Consumer Connect makes it easier for retailers to build and integrate consistent, branded customer experiences from the point of purchase through shipping, delivery and possible returns, France added.

“This is another useful tool in the customer experience toolbox that provides a seamless flow through part of the purchase cycle that is typically managed by third parties,” she said.

What It Does

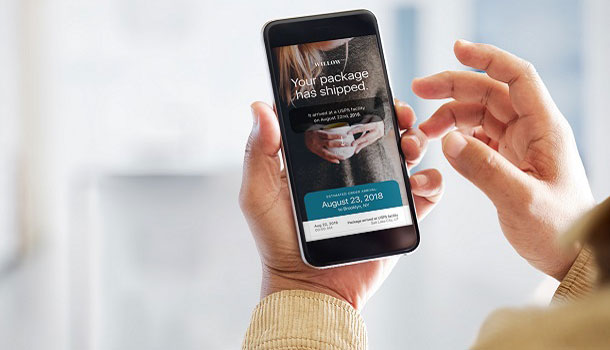

The Consumer Connect service allows customers to track their shipments and stay informed by email and text updates. It lets retailers conveniently send them relevant promotions and product offers.

The service enables customers to initiate product returns with ease, and to engage in meaningful ways when the retail brand promise matters most.

Retailers benefit from Consumer Connect by converting tracking moments to merchandising moments. The service also provides a channel to improve on-brand tracking experiences. In addition, it provides targeted post-purchase consumer engagement and seamless returns.

The new service helps retailers take advantage of touchpoints along the customer’s journey that previously were underutilized and not recognized as engagement opportunities. It transforms post-purchase interactions from Order Tracking to an extension of the brand experience, according to Pitney Bowes.

Around the Clock Engagement

Another benefit to retailers is the Publisher feature — a 24/7 self-service content management system that allows retailers to customize their branded post-purchase experience in minutes.

Consumers will be attracted to Consumer Connect for its brand-consistent immersive experience, according to Pitney Bowes’ Snyder. It will help drive sales, decrease call center volumes, and increase customer loyalty.

That attraction may defeat the practice of online shoppers venting their frustrations on social media about a bad customer experience. Those negative reactions can hurt a retailer’s brand.

Post-Purchase Matters Have Consequences

About 90 percent of online shoppers in the U.S. will take potentially damaging action if they have an unsatisfactory post-purchase experience, according to Pitney Bowes’ 2018 Global Ecommerce Study. Their reactions range from sharing frustrations on social media to never again purchasing from the offending site.

Among millennials, 30 percent will go public about their poor experience, complaining in an online review or social media post, potentially affecting the buying decisions of others in their social networks.

Successful high-growth retailers — 25 percent or greater year-on-year revenue growth — place a greater emphasis on the post-purchase consumer experience than their slower-growth competitors, according to the study.

This includes providing services like free returns and day-definite guaranteed delivery. The study revealed that 92 percent of consumers will buy again from a brand if returns are easy.

Validating Strategy

The Pitney Bowes study validated the need for an after-purchase follow-up service such as Consumer Connect. For instance, 54 percent of high-growth retailers offer two-to-three day free shipping. Yet 60 percent of low-growth retailers, defined as 10 percent or less year-on-year, offer four-to-seven day free shipping.

High-growth retailers tend to meet or exceed consumer demands for accurate, real-time tracking, free and fast shipping, easy returns with preprinted labels, prompt refunds, and even attractive branded packaging.

“Successful high-growth retailers and brands not only exceed their customers’ expectations on the post-purchase experience, but they leverage every consumer touchpoint to build brand awareness, further strengthening customer loyalty,” said Snyder.

Ups and Downs

On the plus side, Consumer Connect hits most of the marketing high points spot-on.

Retail is an increasingly fraught and difficult way to make a living due to aggressive competition and cutthroat pricing, according to Charles King, principal analyst at Pund-IT.

“Given those factors, fulfillment and delivery services can be a minefield for retailers, so offering them ways to add branded, consumer-centric transparency to the process should be welcome,” he told CRM Buyer.

The most problematic issue for Pitney Bowes is that the company is attempting to insert Consumer Connect into processes where effective tracking services already are provided by major delivery organizations, like the USPS, UPS and FedEx, King added.

Pitney Bowes’ situation is problematic in that its profile remains connected — at least in most people’s minds — with the company’s once dominant position in postage scales/sales/fulfillment. That business has cratered, and the company’s shares have dropped from about $28.00 to just over $7.00 during the past five years.

“The company obviously needs to branch out into new markets, but ones where it can leverage its experience and demonstrate its continuing value and relevance. Pitney Bowes’ Consumer Connect looks like a valid way to do just that,” said King.

Comparing Options

Consumer Connect targets independent shipping and fulfillment SMBs looking for ways to differentiate themselves in markets increasingly dominated by major carriers, King noted. They stand to gain a way to affordably promote their services and improve the value they offer to the e-commerce businesses they serve.

“Consumer Connect is also designed to help smaller companies compete against large retailers’ branded fulfillment and delivery services,” he said. “It seems fine on the surface, but it will take a while to see whether, or to what degree, its target customers respond.”

Other Players

Companies such as Narvar and ShipStation provide similar services, noted Constellation’s France. However, Pitney Bowes has the advantage of combining its service with a range of related services, including customer data analytics.

The combination of execution services with analytics that help to provide context and insights into customer preferences is powerful, she said. It is what helps companies evolve everything from what they sell to the ways they engage their customers.

“Getting more of these capabilities from one place can be a real advantage for retailers,” France said, that are “juggling an ever-expanding set of tools and services to support their customer relationships.”